Commerce setup for at the moment: General development of the market remains to be damaging, index under all essential shifting averages, wager with warning – #INA

Inventory market : After promoting all through the final week, a acquire of 0.70 p.c was seen out there on December 23. Nifty 50 index climbed above 200-day EMA (23,700), which is essential for its additional journey. Nevertheless, the momentum indicator MACD (Shifting Common Convergence Divergence), has proven a damaging development on each every day and weekly charts. On the upside, Nifty could face resistance at 23,850. After that the following massive resistance is at 24000. Market specialists say that on the draw back, Nifty is predicted to take fast help at 23,700, after which the following main help shall be at 23,550 (close to final week’s low).

Right here we’re providing you with some such figures on the idea of which will probably be simple so that you can catch worthwhile offers.

Key help and resistance ranges for Nifty

Necessary degree for Nifty 50 (23,753)

Help primarily based on pivot level: 23,672, 23,619 and 23,534

Registration primarily based on pivot level: 23,842, 23,894 and 23,979

Nifty has shaped a doji like and inside bar candlestick sample on the every day chart. This is a sign of indecision between bulls and bears. Momentum indicator RSI (Relative Energy Index) stood at 38.6, which is within the decrease band. This can be a damaging signal. Furthermore, Nifty remains to be under essential key shifting averages (10, 20, 50 and 100-day EMA), although it’s barely above the 200-day EMA.

financial institution nifty

Necessary degree for Financial institution Nifty (51,318)

Registration primarily based on pivot factors: 51,403, 51,494, and 51,642

Help primarily based on pivot factors: 51,107, 51,016, and 50,868

Resistance primarily based on Fibonacci retracement: 51,864, 52,246

Help primarily based on Fibonacci retracement: 50,672, 49,787

Financial institution Nifty outperformed the benchmark Nifty and shaped a bullish candlestick sample like Bullish Harami which is a development reversal sample. Nevertheless, sentiment stays bearish because the banking index is buying and selling under all essential shifting averages (besides 200-day EMA) and 50% Fibonacci retracement ranges (from November low to December excessive) .

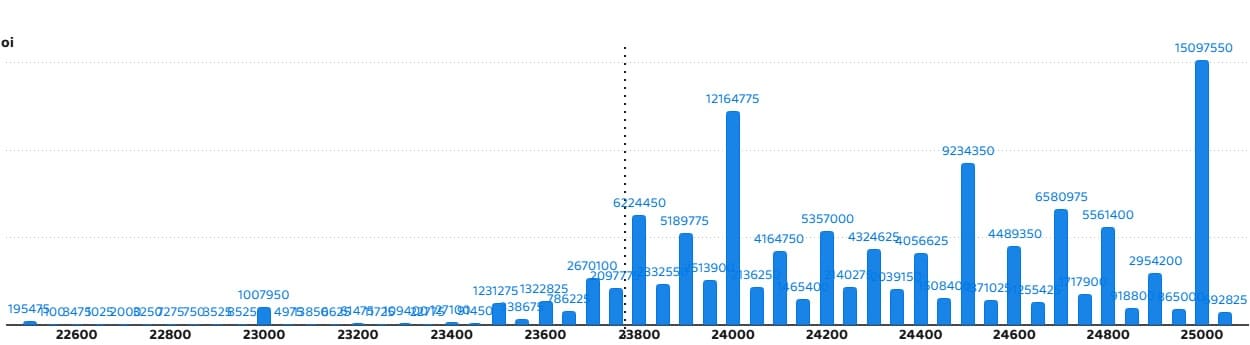

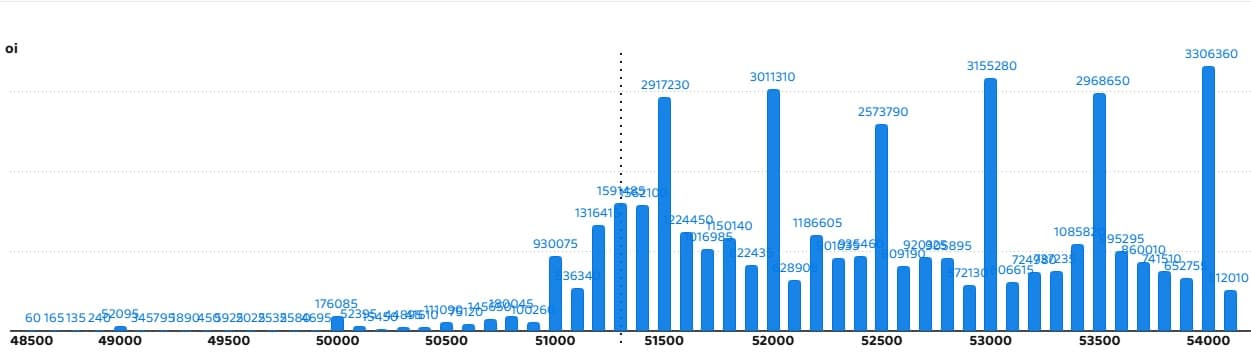

nifty name choice information

Most name open curiosity of 1.5 crore contracts has been seen in Nifty on the strike of 25,000, which can act as an essential resistance degree within the coming buying and selling periods.

nifty put choice information

A most put open curiosity of 1 crore contracts has been seen on the strike of Rs 23,500, which can act as an essential help degree within the coming buying and selling periods.

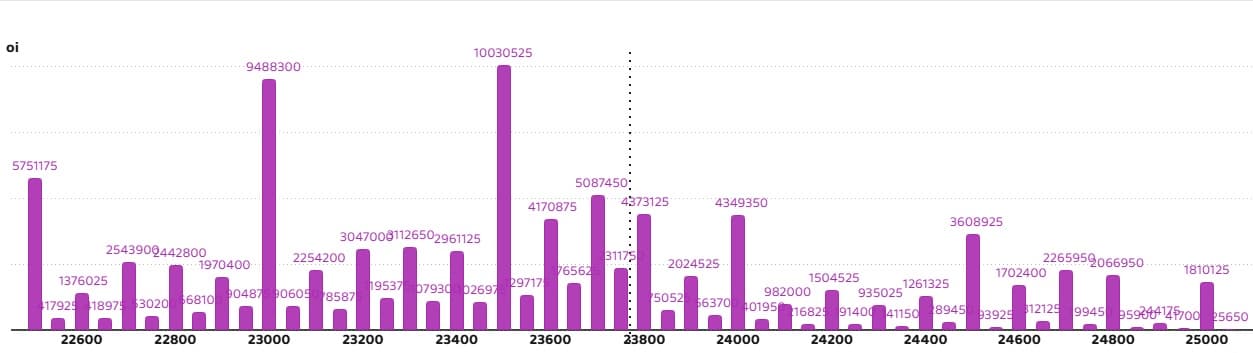

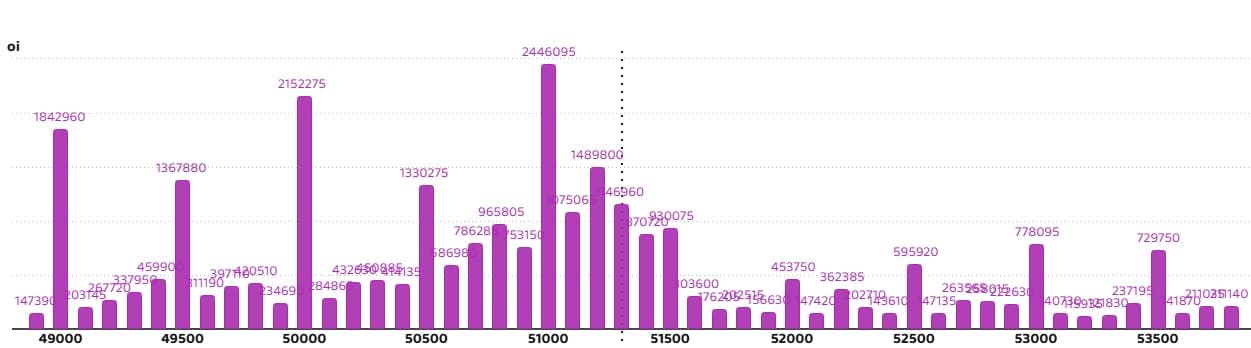

financial institution nifty name choice information

Financial institution Nifty has seen a most name open curiosity of 33.06 lakh contracts on the strike of 54,000, which can act as an essential resistance degree within the coming buying and selling periods.

financial institution nifty put choice information

Financial institution Nifty has seen a most put open curiosity of 24.46 lakh contracts on the strike of 51,000, which can act as an essential help degree within the coming buying and selling periods.

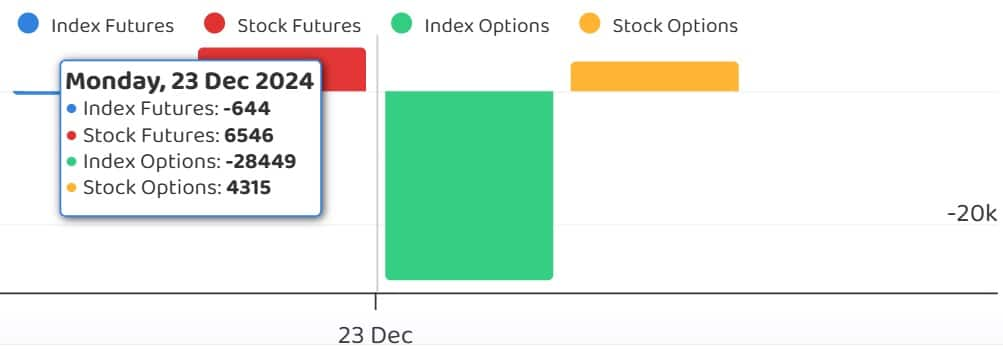

FII and DII fund flows

India VIX

There was a pointy decline of 10.3 p.c within the volatility index India VIX. It has fallen to 13.52 from the earlier degree of 15.07. Because of which the development has turn into extra favorable for the bulls.

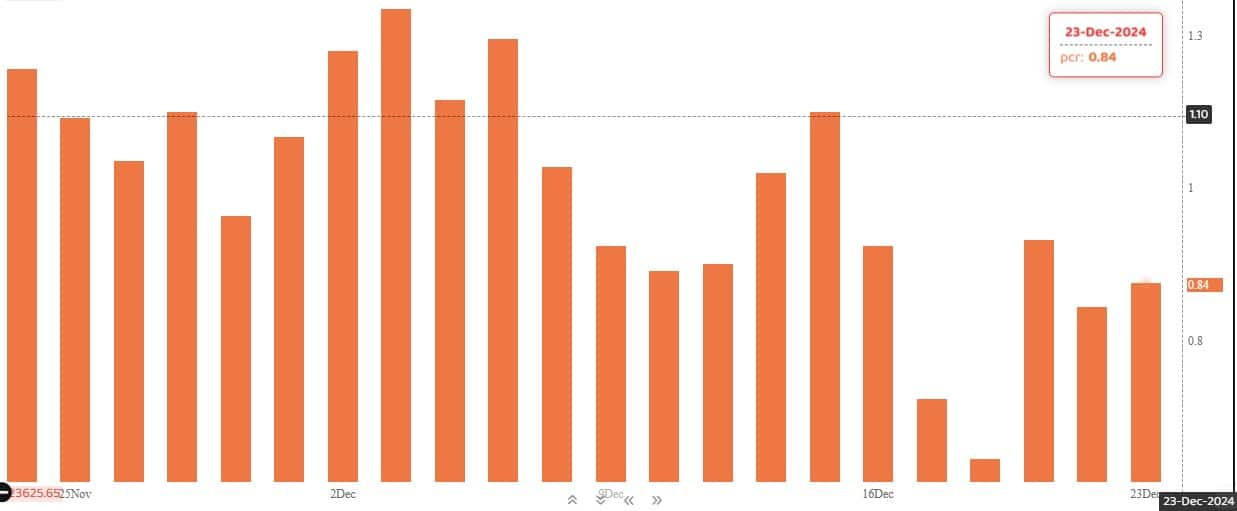

put name ratio

The Nifty put-call ratio (PCR), which displays market sentiment, rose to 0.84 on December 23 from 0.8 within the earlier session. It’s noteworthy that PCR going above 0.7 or crossing 1 is usually thought of an indication of bullish sentiment. Whereas a ratio falling under 0.7 or in direction of 0.5 signifies bearish sentiment.

Specialists views: Bullish Harami cross sample on every day chart is giving bullish alerts, sensible restoration could be seen out there

Shares coated below F&O ban

Restricted securities below the F&O phase embody these corporations whose spinoff contracts exceed 95 per cent of the market broad place restrict.

Newly included shares in F&O ban: no person

Shares already included in F&O restrictions: Bandhan Financial institution, Granules India, Hindustan Copper, Manappuram Finance, RBL Financial institution

Shares faraway from F&O ban: SAIL

Disclaimer: The views expressed on Moneycontrol.com are the non-public views of the specialists. The web site or administration shouldn’t be chargeable for this. Cash Management advises customers to hunt the recommendation of a licensed skilled earlier than taking any funding determination.

Commerce setup for at the moment: General development of the market remains to be damaging, index under all essential shifting averages, wager with warning

देश दुनियां की खबरें पाने के लिए ग्रुप से जुड़ें,

#INA #INA_NEWS #INANEWSAGENCY

Copyright Disclaimer :-Below Part 107 of the Copyright Act 1976, allowance is made for “truthful use” for functions resembling criticism, remark, information reporting, instructing, scholarship, and analysis. Honest use is a use permitted by copyright statute that may in any other case be infringing., instructional or private use suggestions the steadiness in favor of truthful use.

.webp)