Commerce setup for right now: The market will stay within the vary of 23400-24000 for the following few days, the extent of 23500 can be necessary. – INA NEWS

Nifty Commerce Setup: Nifty confirmed a powerful restoration after breaking the November low intraday and closed the final session of the calendar yr on December 31 with a slight achieve. The index defended the upward sloping assist development line on a closing foundation for one more session, elevating hopes of a bullish return to the market. Nevertheless, the general sentiment stays bearish. Market specialists recommend that Nifty might commerce within the vary of 23,400-24,000 within the upcoming few classes of the New 12 months. If Nifty maintains the extent of 23,500 on closing foundation then an increase in direction of 23,900 is feasible. Conversely, a decisive shut under 23,500 may take the index in direction of 23,300, which is the November low.

Right here we’re providing you with some such figures on the premise of which it is going to be straightforward so that you can catch worthwhile offers.

Essential stage for Nifty 50 (23,658)

assist primarily based on pivot level : 23,511, 23,457 and 23,369

Registration primarily based on pivot level: 23,666, 23,740 and 23,828

Nifty shaped a bullish candlestick sample with mild higher and enormous decrease shadows on the each day chart. This can be a sign for a counterattack by the bulls after an tried draw back breakout. Regardless of this restoration, the index stays under all main shifting averages. Moreover, momentum indicators like RSI, MACD and KST are sustaining a unfavorable development, indicating underlying weak spot available in the market.

Key stage for Financial institution Nifty (50,887)

Registration primarily based on pivot factors: 50,892, 51,016, and 51,148

Assist primarily based on pivot factors: 50,670, 50,588, and 50,456

Resistance primarily based on Fibonacci retracement: 51,578, 52,128

Assist primarily based on Fibonacci retracement: 50,664, 49,787

Financial institution Nifty additionally shaped a bullish candlestick sample on the each day time-frame after a powerful restoration from the day’s low. It discovered assist on the 200-day SMA and December 20 low, growing the probabilities of an upside rally. Nevertheless, the general sentiment is bearish. The index is buying and selling under the ten, 20, 50 and 100-day EMAs and throughout the decrease band of Bollinger Bands. Momentum indicators stay within the unfavorable zone, indicating a cautious strategy.

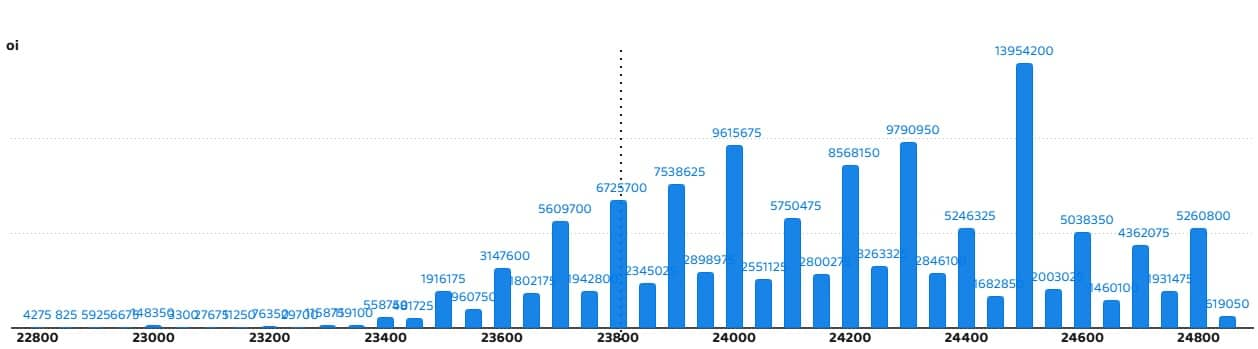

nifty name choice knowledge

On weekly foundation, most name open curiosity of 1.39 crore contracts has been seen on the strike of 24,500 which can act as an necessary resistance stage within the coming buying and selling classes.

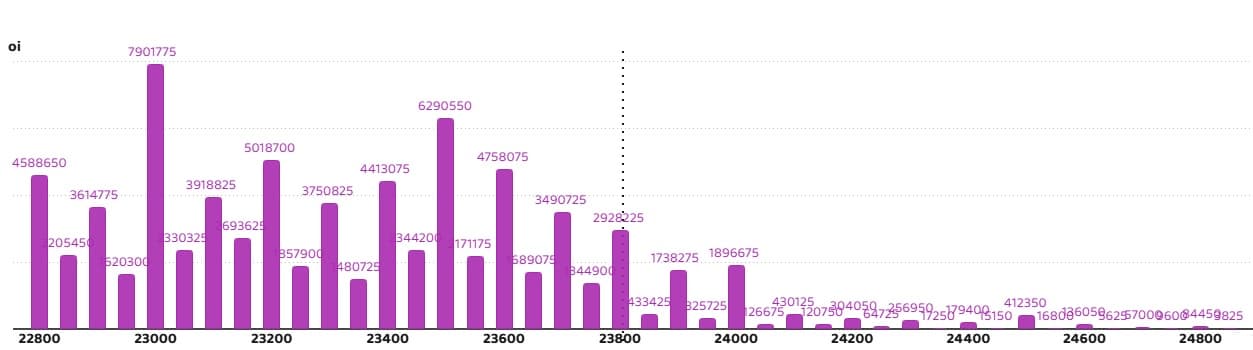

nifty put choice knowledge

Most Put Open Curiosity of 79.01 lakh contracts has been seen on the strike of 23,000 which can act as an necessary assist stage within the coming buying and selling classes.

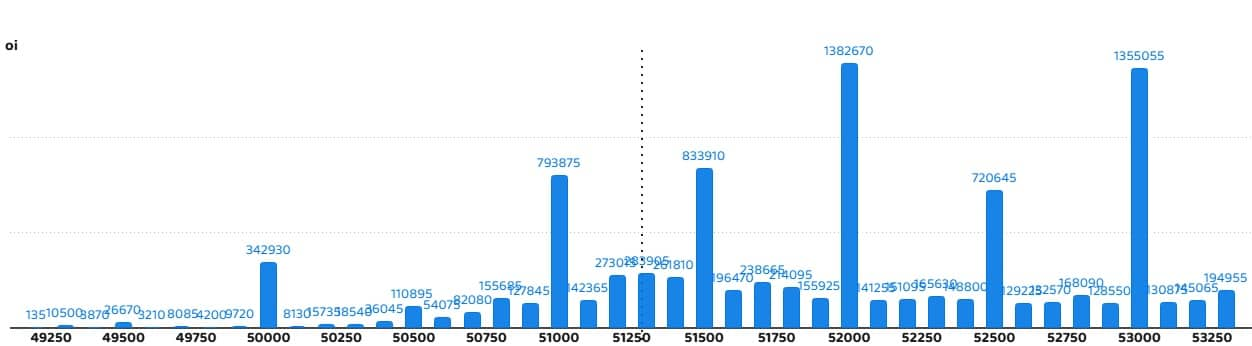

financial institution nifty name choice knowledge

Financial institution Nifty has seen a most name open curiosity of 13.82 lakh contracts on the strike of 52,000, which can act as an necessary resistance stage within the coming buying and selling classes.

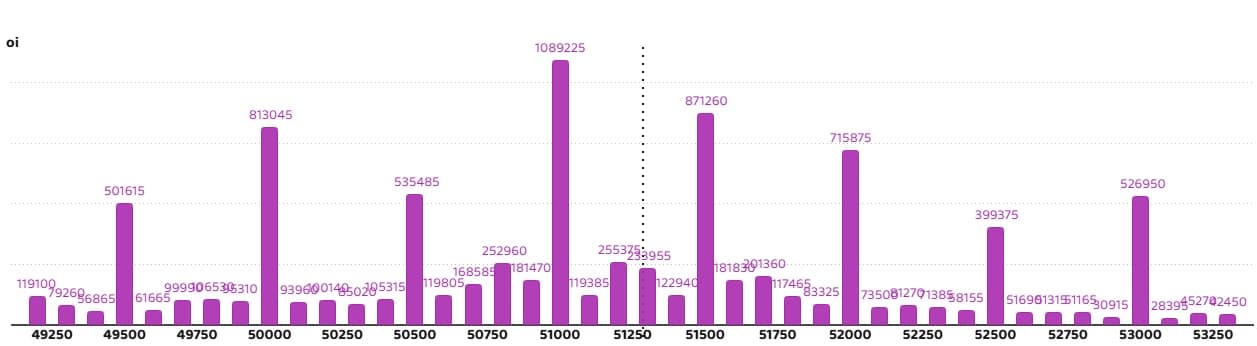

financial institution nifty put choice knowledge

Most Put Open Curiosity of 10.89 lakh contracts has been seen on the strike of 51,000 which can act as an necessary resistance stage within the coming buying and selling classes.

Consolidated Outlook for 2025: Constructive returns available in the market for the ninth consecutive yr, know from brokerage how the state of affairs could also be in 2025

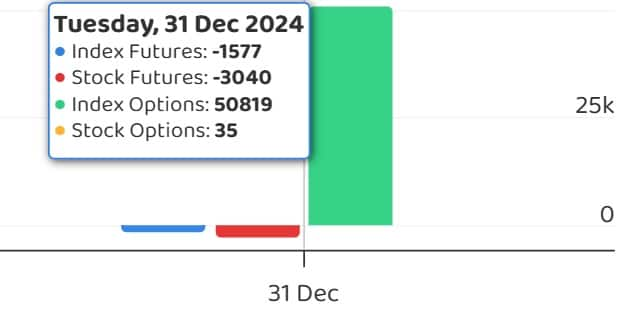

FII and DII fund flows

India VIX

India VIX, which measures market volatility, went above 14 and closed at 14.45, up 3.4 per cent. This can be a sign of warning for bulls. If VIX stays above this stage, bulls ought to stay cautious.

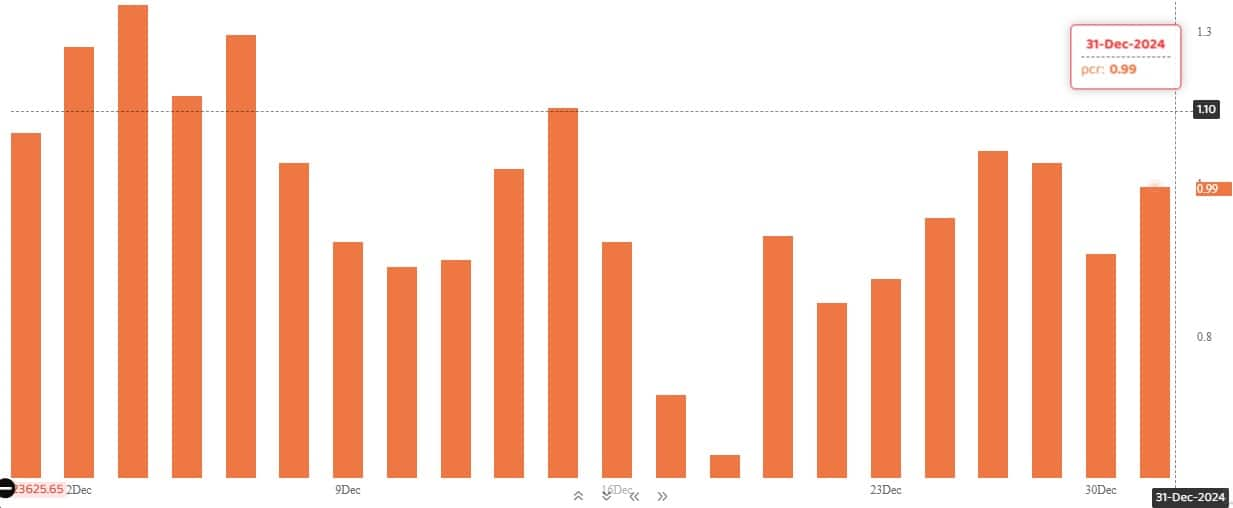

put name ratio

The Nifty Put-Name Ratio (PCR), which displays market temper, elevated to 0.99 on December 31 from 0.88 within the earlier session. It’s noteworthy that PCR going above 0.7 or crossing 1 is mostly thought of an indication of bullish sentiment. Whereas a ratio falling under 0.7 or in direction of 0.5 signifies bearish sentiment.

Shares coated beneath F&O ban

Restricted securities beneath the F&O section embrace these corporations whose by-product contracts exceed 95 per cent of the market vast place restrict.

Newly included shares in F&O ban: no one

Shares already included in F&O restrictions: no one

Shares faraway from F&O ban: no one

Disclaimer: The views expressed on Moneycontrol.com are the non-public views of the specialists. The web site or administration isn’t accountable for this. Cash Management advises customers to hunt the recommendation of an authorized knowledgeable earlier than taking any funding choice.

Commerce setup for right now: The market will stay within the vary of 23400-24000 for the following few days, the extent of 23500 can be necessary.

देश दुनियां की खबरें पाने के लिए ग्रुप से जुड़ें,

#INA #INA_NEWS #INANEWSAGENCY

Copyright Disclaimer :-Beneath Part 107 of the Copyright Act 1976, allowance is made for “honest use” for functions equivalent to criticism, remark, information reporting, instructing, scholarship, and analysis. Honest use is a use permitted by copyright statute that may in any other case be infringing., academic or private use ideas the steadiness in favor of honest use.