Dalal Avenue Week Forward: Q3 outcomes, Trump’s coverage will probably be in focus, these elements will resolve the market motion – INA NEWS

Dalal Avenue: Final week, the 30-share BSE Sensex fell 759.58 factors or 0.98 p.c. On the identical time, the Nifty of Nationwide Inventory Alternate (NSE) recorded a decline of 228.3 factors or 0.97 p.c. Now subsequent week, the route of Indian inventory markets will probably be determined by the quarterly outcomes of huge corporations like HDFC Financial institution, ICICI Financial institution, bulletins after Donald Trump takes oath as US President and the exercise of International Portfolio Traders (FPIs). Analysts have expressed this opinion. Allow us to inform you that Trump will take oath as US President for the second time period on Monday.

Consultants’ opinion

“Markets are anticipated to stay cautious within the brief time period as a result of reasonable expectations within the third quarter, whereas continued FII withdrawals might enhance volatility,” mentioned Vinod Nair, head of assets, Geojit Monetary Providers. Based on him, the brand new US President’s insurance policies and feedback (particularly on tariffs) will probably be intently monitored. He mentioned that prime inflation in Japan or strict coverage of the Financial institution of Japan (BoJ) may also have an effect on the market sentiment.

quarterly outcomes

Despite the fact that Reliance Industries posted a 5 per cent rise with the announcement of wholesome progress throughout key segments, Q3 efficiency has been combined to date. Cautious feedback from IT sector giants and below-expected efficiency by Axis Financial institution have affected the market sentiment. In such a state of affairs, the market will control the company earnings season beginning subsequent week. About 245 corporations are going to declare their outcomes subsequent week. Large corporations amongst them are HDFC Financial institution, Hindustan Unilever, Dr Reddy’s Laboratories, UltraTech Cement, JSW Metal, ICICI Financial institution and Bharat Petroleum Company.

Other than this, different corporations whose quarterly outcomes are anticipated embody Zomato, One 97 Communications Paytm, InterGlobe Aviation, Tata Applied sciences, L&T Finance, Dixon Applied sciences, Financial institution of India, IDFC First Financial institution, Sure Financial institution, IDBI Financial institution, Indian Railway Finance. Company, ICICI Securities, Jammu & Kashmir Financial institution, MCX India, Oberoi Realty, Dalmia Bharat, ICICI Prudential Life Insurance coverage, India Cements, KEI Industries, PNB Housing Finance, South Indian Financial institution, UCO Financial institution, Coforge, Gravita India, HUDCO, Nuvoco Vistas Company, Persistent Techniques, Pidilite Industries, Polycab India, Tata Communications, Adani Inexperienced Power, Scient, Greaves Cotton, Hindustan Petroleum Company, Indian Power Alternate, Indus Towers, Mankind Pharma, Mphasis, Nippon Life India Asset Administration, Sona BLW Precision Forgings, Syngen Worldwide, United Spirits, DLF, Godrej Client Merchandise, Jindal Noticed, Torrent Prescribed drugs, and Balkrishna Industries.

tariff phobia

Donald Trump will probably be sworn in because the forty seventh President of America on January 20. Together with this, coverage bulletins of his administration may also be made. Consultants imagine that these bulletins can influence international market sentiment. Throughout his final presidential time period, Trump’s insurance policies primarily centered on defending home industries.

FII Stream

The rise in DXY and US bond yields is impacting FII flows into India. Due to this fact, the market will probably be intently watching FII exercise. After heavy promoting within the money section final 12 months, 2025 additionally began with FII withdrawals. FIIs internet bought shares price over Rs 25,000 crore final week, taking their complete outflow in January 2025 to Rs 46,576 crore (provisional figures). Nevertheless, Home Institutional Traders (DII) supported the market. They purchased shares price Rs 49,367 crore within the month, nearly offsetting FII promoting.

oil costs

Rising crude oil costs is one other necessary issue that the market will control, particularly for oil importing nations like India. Persevering with its rally for the fourth consecutive week, Brent crude futures (the worldwide oil benchmark) closed 1.29 per cent larger at $80.79 per barrel final week, its highest since July 2024. The truth is, costs have moved above all main weekly shifting averages (akin to 10, 20, 50, 100 and 200-week EMAs), which give a optimistic sign.

international financial knowledge

Within the coming week, the market will control the rate of interest coverage of the Central Financial institution of Japan (BoJ) and the nation’s inflation knowledge. Other than this, US Weekly Jobs knowledge and January Manufacturing and Providers Flash PMI knowledge of many nations like US, UK, and Japan may also be necessary. These figures can play an necessary function in deciding the route of the worldwide market.

Home Financial Information

The route of Indian markets may also be determined by the HSBC Manufacturing and Providers PMI knowledge for the month of January, which will probably be launched on twenty fourth of this month. Other than this, the overseas alternate reserve knowledge for the week ending January 17 may also be launched on the identical day, which can influence the market sentiment.

Foreign exchange reserves have been falling repeatedly because the final week of September, when it reached a file excessive of $704.885 billion. On January 10, reserves stood at $625.871 billion, which was additionally $8.714 billion lower than on January 3. Consultants attributed this regular decline to the foreign exchange market intervention in addition to revaluation by the RBI (Reserve Financial institution of India) to assist curb rupee fluctuations.

Final week, the rupee weakened 0.47 per cent and touched an all-time low of 86.69 towards the greenback, however ended the week at 86.55 towards the greenback. The rupee continued to say no towards the greenback for the eleventh consecutive week.

IPO

Within the week ranging from January 20, buyers may have the chance to speculate cash in 5 new IPOs. Of those, just one Denta Water IPO is from the mainboard section. The 4 different IPOs embody CapitalNumbers Infotech, Rexpro Enterprises, CLN Power and GB Logistics Commerce.

Other than this, there will probably be a chance to speculate cash in 3 already opened IPOs within the new week, one among which is Stallion India IPO mainboard section. Speaking about itemizing, 7 corporations are going to make their debut within the inventory market within the new beginning week.

technical view

Speaking about technicality, Nifty 50 is wanting weak. It’s buying and selling properly under all main shifting averages on the every day charts, and can also be under the ten, 20 and 50-week shifting averages. The index shaped a doji candlestick sample on the weekly chart, which exhibits confusion between bulls and bears out there.

Consolidation is prone to proceed out there subsequent week, the place 23050 (final week’s low) will act as a key help zone. Based on specialists, if this stage is damaged decisively, a serious selloff might start out there, as a result of which the index might fall to the extent of 22800. On the upside, 23400 will act as an instantaneous resistance. If this resistance is crossed then 23700-23900 ranges will probably be necessary out there which can should be monitored.

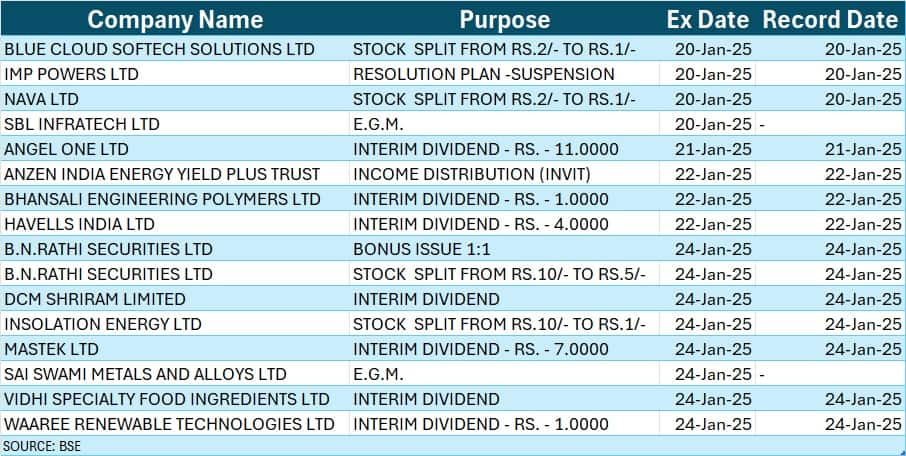

company motion

Key company actions going down within the coming week are as follows:

Disclaimer: The data offered right here is being offered for info solely. You will need to point out right here that investing out there is topic to market dangers. As an investor, all the time seek the advice of an professional earlier than investing cash. Moneycontrol by no means advises anybody to speculate cash right here.

Dalal Avenue Week Forward: Q3 outcomes, Trump’s coverage will probably be in focus, these elements will resolve the market motion

देश दुनियां की खबरें पाने के लिए ग्रुप से जुड़ें,

#INA #INA_NEWS #INANEWSAGENCY

Copyright Disclaimer :-Underneath Part 107 of the Copyright Act 1976, allowance is made for “honest use” for functions akin to criticism, remark, information reporting, instructing, scholarship, and analysis. Honest use is a use permitted by copyright statute that may in any other case be infringing., instructional or private use ideas the steadiness in favor of honest use.