Draft for Pine Labs’ IPO could also be filed by mid-February, would be the largest public concern in fintech after Paytm. – INA NEWS

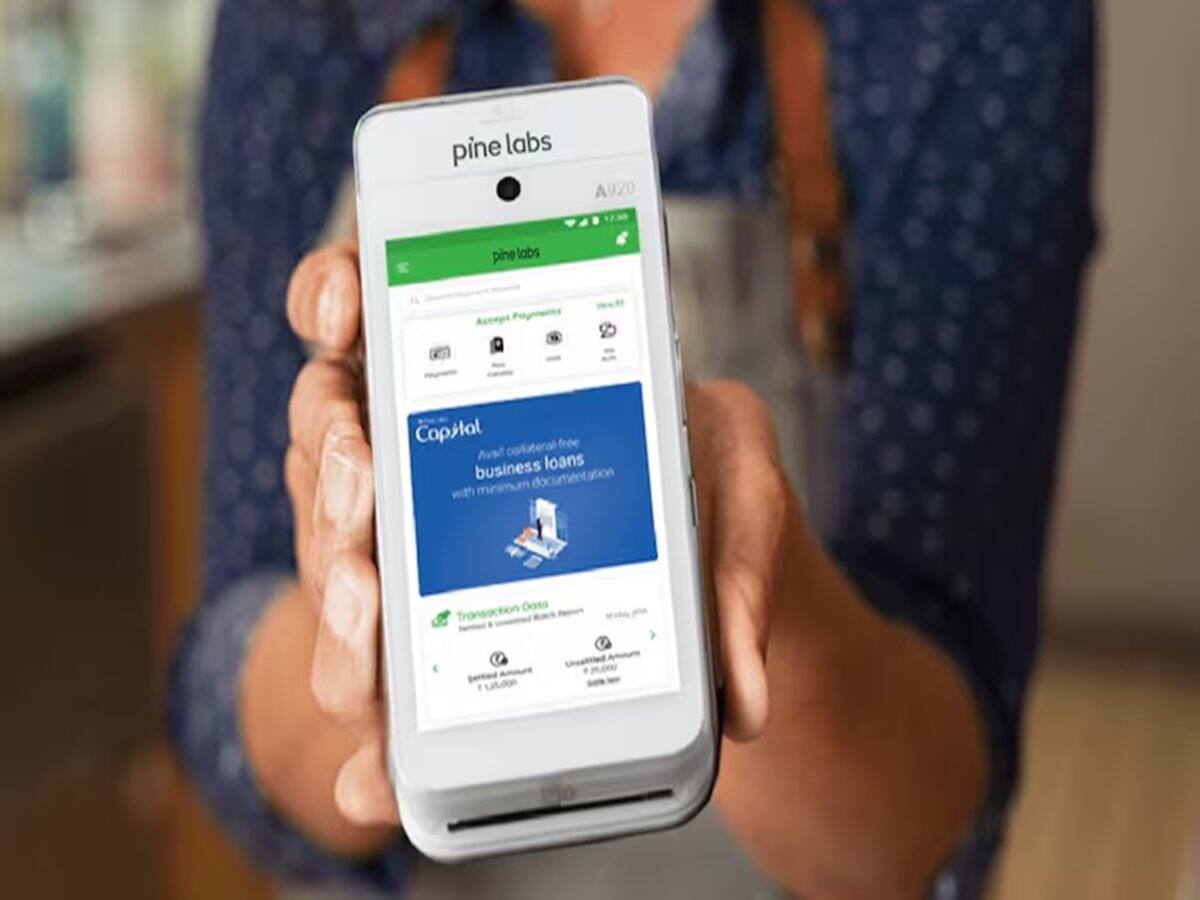

Pine Labs IPO: Fintech firm Pine Labs might file draft paperwork for its IPO by mid-February. Work on this is occurring at a quick tempo. Sources stated that after the completion of the formalities of transferring the bottom of Pine Labs from Singapore to India, the corporate desires to enter the Indian capital market as quickly as doable. Bankers say that the corporate goals to be listed within the inventory market by August. Pine Labs offers on-line and offline gateway companies to e-commerce and retail retailers along with gifting and credit score.

Axis Capital, Citi, Morgan Stanley, Jefferies and JP Morgan have been appointed service provider bankers for the corporate’s IPO. Sources stated that Pine Labs’ IPO may very well be the most important IPO within the funds house after Paytm’s IPO of greater than $20 billion in 2021.

How a lot can the valuation be?

Nevertheless, Pine Labs has not but determined its valuation. Bankers stated the corporate can not demand an excessive amount of of a premium in comparison with its earlier funding rounds. The valuation within the firm’s final funding spherical was $5 billion. In April 2024, Baron Funds pegged the valuation of Pine Labs at $5.8 billion, whereas Invesco put it at $4.8 billion.

Shreeji Transport International will deliver IPO, papers filed with SEBI

“After the submitting of the draft crimson herring prospectus (DRHP), the corporate will begin its roadshow and this may assist in the worth discovery course of. The goal is to launch cash to traders,” stated a banker. In such a state of affairs, the valuation of Pine Labs may very well be round $6-8 billion (Rs 50,000-70,000 crore), which might make it an IPO of $1.2-1.5 billion.

Whose cash is it?

Non-public fairness traders, enterprise capital and overseas funds have invested cash in Pine Labs. These embrace names like Peak XV, PayPal Ventures, Alpha Wave International, Temasek and Mastercard. Sources stated that current traders can promote about 20 % of the corporate within the IPO. There can also be new shares within the IPO of Pine Labs. In response to Traxon, Pine Labs has raised about $1.32 billion in 14 rounds since 2009.

Draft for Pine Labs’ IPO could also be filed by mid-February, would be the largest public concern in fintech after Paytm.

देश दुनियां की खबरें पाने के लिए ग्रुप से जुड़ें,

#INA #INA_NEWS #INANEWSAGENCY

Copyright Disclaimer :-Underneath Part 107 of the Copyright Act 1976, allowance is made for “honest use” for functions reminiscent of criticism, remark, information reporting, educating, scholarship, and analysis. Truthful use is a use permitted by copyright statute that may in any other case be infringing., instructional or private use ideas the stability in favor of honest use.