Market This Week: How will the inventory market transfer this week? These necessary elements together with Q3 outcomes, inflation figures will resolve – INA NEWS

The benchmark indices fell sharply by greater than 2 per cent within the week ending January 10. The broader index fell greater than the benchmark indices because of a discount in GDP development estimates for the total yr, rising oil costs and continued promoting by international institutional buyers. An increase in US bond yields and power within the US greenback index additionally influenced sentiment. Aside from this, there’s some uncertainty available in the market concerning the coverage actions that may be taken by Donald Trump, who will take cost as US President on January 20.

Nifty50 fell 573 factors to 23,432, its lowest stage since June 2024. BSE Sensex fell 1,844 factors to 77,379. The Nifty Midcap 100 and Smallcap 100 indices have been down 5.77 per cent and seven.3 per cent, respectively. All sectors besides IT have been beneath stress. Consolidation is predicted available in the market within the subsequent week ranging from January 13. Tell us which elements will play an necessary function in deciding the route of the market within the new beginning week.

Q3 earnings of corporations

Market individuals will primarily regulate the third quarter outcomes of corporations. Within the new week, Reliance Industries, Infosys, HCL Applied sciences, Tech Mahindra, Wipro, Kotak Mahindra Financial institution, HDFC Life Insurance coverage Firm, Axis Financial institution, SBI Life Insurance coverage will launch their Q3FY25 outcomes. Aside from this, HDFC AMC, LTIMindTree, L&T Know-how Companies, Jio Monetary Companies, RBL Financial institution, Indian Accommodations, Anand Rathi Wealth, Angel One, Delta Corp, Network18 Media and Investments, Buyers Cease, CEAT, Financial institution of Maharashtra, Havells India, Mastek, Metro Manufacturers, Sterling & Wilson Renewable Power, Ather Industries, Harmony Enviro Programs and ICICI Lombard Basic Insurance coverage Firm may also launch Q3 earnings.

December inflation figures

Retail inflation figures for the month of December will probably be launched on January 13. These will play an necessary function in shaping the route of the market. Most economists anticipate inflation figures to say no additional within the final month of 2024. Aside from this, wholesale inflation figures for December will probably be launched on January 14. It might enhance. Financial institution credit score and deposit development information for the 15-day interval ending January 3 and international trade reserves information for the week ending January 10 will probably be launched on January 17.

American inflation

On the worldwide entrance, all eyes will probably be on US inflation information. International economists see a modest enhance in inflation information in December. Core inflation is predicted to stay steady at 3.3 p.c. Moreover, PPI, retail gross sales, housing development, industrial manufacturing information and weekly employment information for December may also be monitored.

FPI promoting not stopping, ₹22194 crore withdrawn from shares up to now in January

China’s GDP and different international financial information

China’s GDP numbers for the October-December quarter of 2024 may also be intently watched. Analysts imagine it’s prone to be round 5 p.c. As well as, inflation information from Europe and the UK and automobile and retail gross sales information from China may also be considered.

FII flows and rupee

International institutional buyers (FIIs) remained internet sellers final week. On a brief foundation, they offered Rs 16,854 crore within the money section. Their outflow for the present month of January because of excessive valuations was Rs 21,357 crore. Nevertheless, home institutional buyers (DIIs) totally offset FII withdrawals and purchased shares value Rs 21,683 crore final week. DIIs have purchased shares value Rs 24,216 crore up to now in January.

The Indian Rupee hit a brand new low of 86.1450 (which was additionally a closing stage) in opposition to the US Greenback. Rupee weakened 0.47 per cent throughout the week because of correction in home markets, promoting by FIIs, robust US greenback and rising oil costs.

oil costs

International buyers may also deal with oil costs, which rose for the third consecutive week after the US introduced sanctions on the Russian oil trade. Expectations of chilly climate within the US and Europe and elevated oil consumption in China throughout the Lunar New Yr additionally boosted costs. Specialists anticipate oil costs to stay supported within the close to time period because the market worries that powerful US sanctions on Russia may impression its crude oil exports to Asia. Brent crude futures, the worldwide benchmark for oil costs, rose 4.25 p.c throughout the week to $79.76 a barrel.

IPO

Laxmi Dental IPO will open on January 13 within the new beginning week. Kabra Jewels IPO, Rikhav Securities IPO will open on January 15. After this, Land Immigration IPO will open on 16 January and EMA Companions IPO will open on 17 January. Speaking about itemizing, on January 13, shares of Commonplace Glass Lining will probably be listed on NSE, BSE and shares of Indobell Insulation will probably be listed on BSE SME. Quadrant Future Tek IPO and Capital Infra Belief Invit will probably be listed on BSE and NSE on January 14. On the identical day, Delta Autocorp IPO will probably be listed on NSE SME and Avax Apparels And Ornaments IPO, BRGoyal IPO on BSE SME. The shares of Sat Kartar Buying will probably be listed on NSE SME on January 17.

m-cap of 5 out of prime 10 corporations diminished by ₹1.85 lakh crore, HDFC Financial institution suffered the most important loss

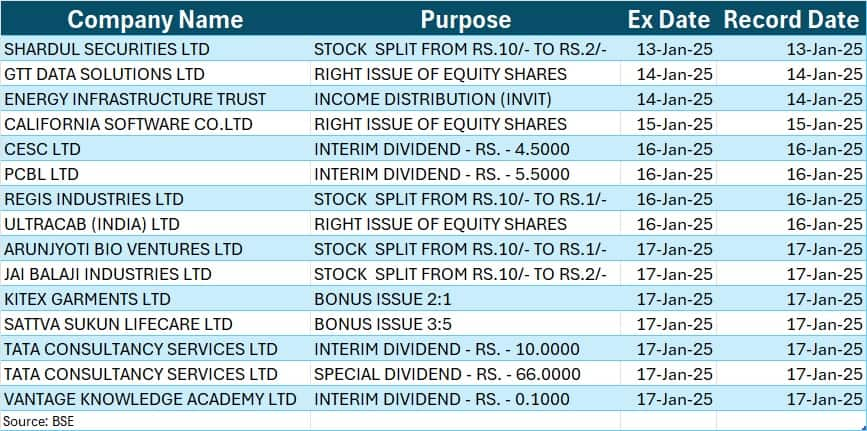

company actions

Listed here are the important thing company actions of subsequent week…

Market This Week: How will the inventory market transfer this week? These necessary elements together with Q3 outcomes, inflation figures will resolve

देश दुनियां की खबरें पाने के लिए ग्रुप से जुड़ें,

#INA #INA_NEWS #INANEWSAGENCY

Copyright Disclaimer :-Below Part 107 of the Copyright Act 1976, allowance is made for “truthful use” for functions corresponding to criticism, remark, information reporting, educating, scholarship, and analysis. Honest use is a use permitted by copyright statute that may in any other case be infringing., academic or private use suggestions the stability in favor of truthful use.

.webp)