Market This Week: How would be the temper of the market this week? Price range 2025 will probably be determined by these essential components together with Q3 outcomes, FOMC meet, US GDP – INA NEWS

The inventory markets additionally declined within the week ending January 24. Benchmark indices fell for the third consecutive week. The promoting continued resulting from continued promoting by FIIs and uncertainty over the financial insurance policies of US President Donald Trump. Other than this, market individuals are trying cautious forward of the Union Price range 2025 and the Federal Reserve’s coverage assembly. Final week, Nifty 50 index fell 111 factors to 23,092 and BSE Sensex fell 429 factors to 76,190. Whereas the Nifty Midcap 100 index declined by 2.5 p.c and the Smallcap 100 index declined by 4 p.c.

Specialists say that the market might stay robust within the new week, taking cues from main occasions just like the Union Price range, US Central Financial institution assembly on coverage charges, quarterly earnings of firms, US GDP figures for the December quarter.

price range 2025

All eyes are on Price range 2025 to be introduced on February 1. Finance Minister Nirmala Sitharaman is anticipated to give attention to measures that promote consumption and help financial development. Specialists consider the fiscal deficit for FY2025 will probably be 4.7-4.8 per cent of GDP, whereas the price range estimate is 4.9 per cent. The federal government has estimated it to be 4.4-4.5 p.c for the monetary 12 months 2026. Earlier than the price range, focus will probably be on PSU and capex themed shares like railways, protection and capital items.

company revenue

Greater than 500 firms will launch December quarter ends in the brand new week. These embody huge firms like Coal India, Oil and Pure Gasoline Company, Tata Metal, Bajaj Auto, Cipla, Bajaj Finance, Bajaj Finserv, Maruti Suzuki, Tata Motors, Larsen & Toubro, IndusInd Financial institution, Nestle India, Solar Pharmaceutical, Adani Enterprises and Adani Ports. Names included.

Moreover, Hyundai Motor India, PB Fintech, Indian Oil Company, GAIL India, Canara Financial institution, Union Financial institution of India, Financial institution of Baroda, Indian Financial institution, Bandhan Financial institution, Shree Cement, ACC, Ambuja Cements, Aditya Birla Solar Life AMC, Adani Whole Gasoline, Adani Wilmar, Bajaj Housing Finance, Emami, Federal Financial institution, Indraprastha Gasoline, BHEL, Bosch, Colgate Palmolive, Exide Industries, JSW Vitality, JSW Infrastructure, Mahindra & Mahindra Monetary Companies, Mahanagar Gasoline, SBI Playing cards, Suzlon Vitality, TVS Motor, Adani Energy, Blue Star, Voltas, Bharat Electronics, Biocon, Dabur India, Jindal Metal & Energy, Kalyan Jewellers, Dr. Lal Pathlabs, Vari Energies, LIC Housing Finance, Marico and Vishal Mega Mart to call a number of. Different huge firms are additionally concerned.

Multibagger Inventory: ₹1 lakh turned ₹3000000 in 5 years, shares rose 180% in only one 12 months

home financial knowledge

On the financial knowledge entrance, fiscal deficit and infrastructure output for December will probably be introduced on January 31. Moreover, financial institution mortgage and deposit development knowledge for the 15-day time interval ending January 17, and international change reserves knowledge for the week ending January 24 will even be launched on the identical day.

Fed rates of interest and US GDP

Globally, market individuals will keep watch over the outcomes of the primary assembly of the US central financial institution Federal Reserve within the new 12 months 2025 and superior estimates of US GDP development for the October-December 2024 quarter. Most economists anticipate the Federal Reserve to maintain the fed funds price within the 4.25-4.5 p.c vary on the Federal Open Market Committee (FOMC) assembly on January 28-29. Federal Reserve Chairman Jerome Powell had indicated within the final assembly to chop rates of interest solely twice within the 12 months 2025.

Other than the Fed’s determination, consideration will even be paid to knowledge on gross sales of latest houses within the US, weekly knowledge on jobs, private revenue and expenditure, actual shopper spending.

international financial knowledge

Market individuals will carefully keep watch over the European Central Financial institution’s transfer and flash knowledge on GDP development for the October-December 2024 quarter. Most specialists consider the European Central Financial institution will lower rates of interest by 25 foundation factors at subsequent week’s assembly. The minutes of the Financial institution of Japan’s financial coverage assembly to be held on January 29 will even be monitored.

FII Move

The market will even keep watch over the exercise of international institutional buyers (FIIs). They’re constantly promoting in India regardless of the autumn in US bond yields and greenback index. FIIs bought shares price Rs 22,500 crore final week, taking their complete promoting in January to Rs 69,080 crore. Then again, home institutional buyers have purchased shares price Rs 66,945 crore to date in January.

The US 10-year bond yield fell 0.13 per cent to 4.617 per cent in the course of the week. The US greenback index declined 1.77 p.c to 107.465. Other than this, the 11-week lengthy dropping streak of the Indian Rupee was damaged.

NTPC Dividend: Dividend reward to shareholders, revenue elevated by 3.1% in December quarter

IPO

Solely 2 new public points are opening within the week beginning twenty seventh January. IPOs of Malpani Pipes And Fittings and Dr Agarwal’s Healthcare will begin on January 29. So far as itemizing is worried, CapitalNumbers Infotech will probably be listed on BSE SME on January 27. After this, on January 29, shares of Denta Water and Infra Options will probably be listed on BSE, NSE within the mainboard section. Rexpro Enterprises will probably be listed on NSE SME on the identical day. CLN Vitality shares will debut on BSE SME on January 30. Whereas on January 31, HM Electro Mech and GB Logistics Commerce will probably be listed on BSE SME.

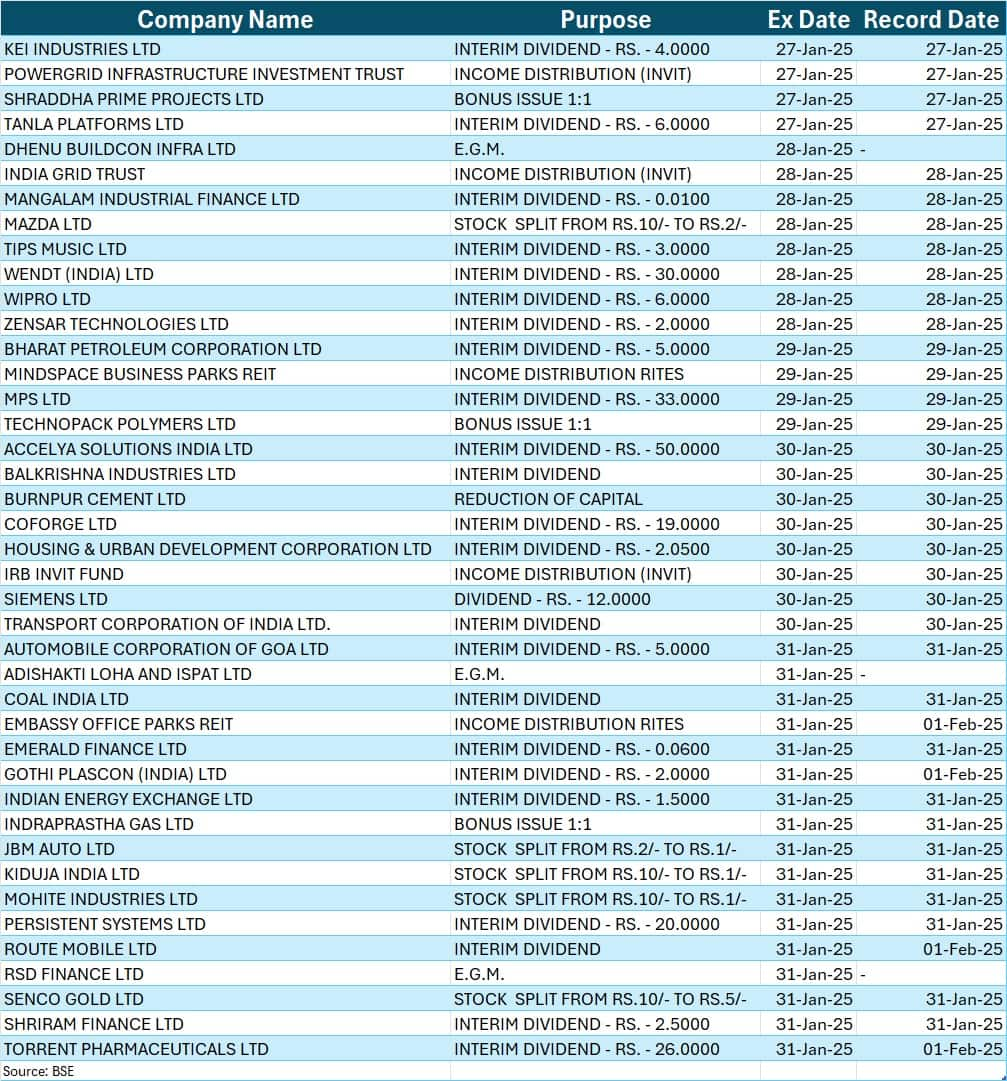

company actions

The most important company actions of the brand new week are as follows…

Market This Week: How would be the temper of the market this week? Price range 2025 will probably be determined by these essential components together with Q3 outcomes, FOMC meet, US GDP

देश दुनियां की खबरें पाने के लिए ग्रुप से जुड़ें,

#INA #INA_NEWS #INANEWSAGENCY

Copyright Disclaimer :-Underneath Part 107 of the Copyright Act 1976, allowance is made for “truthful use” for functions corresponding to criticism, remark, information reporting, instructing, scholarship, and analysis. Honest use is a use permitted by copyright statute that may in any other case be infringing., academic or private use ideas the stability in favor of truthful use.