Market This Week: Which manner will the inventory market transfer this week; These elements together with US unemployment price will determine Q3 outcomes – INA NEWS

The inventory market additionally remained bullish within the week ending January 3. This was the second consecutive week when the market noticed positive factors. Shopping for in auto, FMCG, pharma and oil & fuel shares together with funding by home institutional traders supported the market. The Nifty 50 index rose 0.8% to 24,005 throughout the week, and the BSE Sensex rose 0.67% to 79,223. The Nifty Midcap and Smallcap 100 indices outperformed the benchmark indices, rising 1.67% and 1.48% respectively. Tell us which elements will play an vital position in deciding the route of the market within the new beginning week…

Q3 earnings

Within the new week, all eyes will probably be on the businesses’ earnings for the December 2024 quarter. Tata Consultancy Companies’ December quarter outcomes will probably be launched on January 9 and Avenue Supermarts’s on January 11. Amongst different corporations, Tata Elxsi, Indian Renewable Power Improvement Company, One MobiKwik Methods, CESC, GM Breweries, Transformers & Rectifiers (India), GTPL Hathway, Yash HighVoltage, GNA Axles, PCBL and Valecha Engineering can even launch quarterly earnings within the coming week. Will do.

FOMC assembly minutes

Globally, the main target will probably be on the minutes of the FOMC assembly held in December, during which the US central financial institution Federal Reserve lower rates of interest by 25 foundation factors. The Fed could make solely two price cuts within the 12 months 2025. Aside from this, many financial information factors like US unemployment price, non-farm payroll, JOLTs information of job becoming a member of and leaving, ADP employment change, challenger job cuts, car gross sales and manufacturing unit orders can even be monitored.

FPI began the brand new 12 months with promoting, withdrew ₹ 4285 crore from shares within the first 3 days of January.

international financial information

Buyers will probably be maintaining a tally of providers PMI information for December from a number of developed and growing international locations. Inflation and PPI from China; Unemployment charges, PPI and retail gross sales from Europe; Market contributors can even regulate family spending information from Japan.

oil costs

After fluctuating within the vary of $ 5 per barrel for the previous few months, oil costs are seeing an increase once more. Brent crude futures, the worldwide oil benchmark, closed at $76.51 a barrel, the very best stage since mid-October. It has elevated by 3.7% final week. It’s because China is predicted to offer a stimulus bundle to spice up financial development and America is predicted to chop rates of interest additional by 2025.

home financial information

The main focus of market contributors within the home market will probably be on the ultimate HSBC Service PMI information for December to be launched on January 6. In response to preliminary estimates, the providers PMI reached 60.8 in December, up from 58.4 in November. Aside from this, preliminary estimates for the expansion of the complete 12 months can even be introduced subsequent week on January 7. The Reserve Financial institution of India has estimated that the economic system will develop at a tempo of 6.6% in FY 2025, whereas the expansion in FY 2024 was 8.8%. Some analysts imagine {that a} potential improve in capital expenditure and enchancment in rural demand may help the expansion figures within the second half of FY2025.

Industrial manufacturing and manufacturing output information for November, and international alternate reserves information for the week ending January 3 will probably be launched on January 10.

FII Stream

The exercise of FII (International Institutional Investor) can even be monitored subsequent week. FIIs offered shares price over Rs 11,000 crore within the money section within the week ending January 3. In December, he had offered shares price about Rs 17,000 crore, which was absolutely compensated by DII. DII purchased shares price Rs 34,200 crore in the identical month. NSDL information confirmed that FIIs have purchased shares price Rs 427 crore in equities in 2024. DIIs (home institutional traders) purchased shares price Rs 9,254 crore final week.

The US greenback index crossed the 109-point stage for the primary time since November 2022, closing at 108.92, up 0.85 p.c on the finish of final week. The index continued its uptrend for the fifth consecutive week, whereas the US 10-year Treasury yield remained above 4.5%. The yield stood at 4.602% on Friday.

In the meantime, the Indian rupee continued to stay weak and weakened by 0.44% throughout the week to 85.74 towards the US greenback. That is the bottom stage ever. The rupee continued to say no for the ninth consecutive week.

m-cap of 4 out of high 10 Sensex corporations decreased by ₹96605 crore, HDFC Financial institution suffered the largest loss.

IPO

Indobell Insulation IPO, Normal Glass Lining Expertise IPO will open within the new week on January 6. BRGoyal Infrastructure IPO, Delta Autocorp IPO, Quadrant Future Tek IPO, Avax Apparels And Ornaments IPO and Capital Infra Belief InvIT will open on January 7. Indo Farm Gear IPO will probably be listed on BSE, NSE on January 7 within the week ranging from January 6. Technichem Organics will probably be listed on BSE SME on the identical day. Shares of Leo Dry Fruits and Spices will probably be listed on BSE SME on January 8. Shares of Davin Sons and Parmeshwar Steel will probably be listed on BSE SME on January 9. Fabtech Applied sciences will probably be listed on BSE SME on January 10.

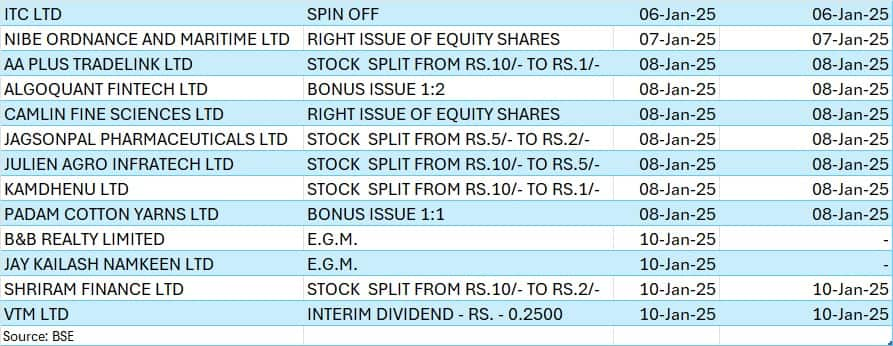

Listed here are the important thing company actions of subsequent week…

Market This Week: Which manner will the inventory market transfer this week; These elements together with US unemployment price will determine Q3 outcomes

देश दुनियां की खबरें पाने के लिए ग्रुप से जुड़ें,

#INA #INA_NEWS #INANEWSAGENCY

Copyright Disclaimer :-Below Part 107 of the Copyright Act 1976, allowance is made for “truthful use” for functions corresponding to criticism, remark, information reporting, instructing, scholarship, and analysis. Honest use is a use permitted by copyright statute that may in any other case be infringing., instructional or private use ideas the stability in favor of truthful use.

.webp)