NACDAC Infra IPO Itemizing: IPO bid 2200 instances, now ₹35 share on itemizing, funding doubled – #INA

NACDAC Infra IPO Itemizing: Shares of infra firm NACDAC Infra had a profitable entry on BSE SME at this time and the cash of IPO buyers doubled on the very first day. Its IPO additionally received an excellent response and total bids had been greater than 2,209 instances. Beneath the IPO, shares have been issued at a value of Rs 35. Immediately it has entered BSE SME at Rs 795.00, which suggests IPO buyers received an inventory acquire of 11 % (NACDAC Infra Itemizing Achieve). After itemizing the shares went up additional. It jumped and reached the higher circuit of Rs 69.82 (NACDAC Infra Share Value), which suggests the cash of IPO buyers has doubled.

NACDAC Infra IPO received sturdy response

NACDAC Infra’s ₹10.01 crore IPO was open for subscription from December 17-19. This IPO obtained an awesome response from buyers and total it was subscribed 2,209.76 instances. On this, the portion reserved for Certified Institutional Consumers (QIB) was crammed 236.39 instances, the portion for Non-Institutional Traders (NII) was 4,084.46 instances and the portion for retail buyers was crammed 2,503.66 instances. Beneath this IPO, 28.60 lakh new shares with face worth of Rs 10 have been issued. The corporate will use the cash raised by these shares to fulfill working capital necessities and for common company functions.

About NACDAC Infra

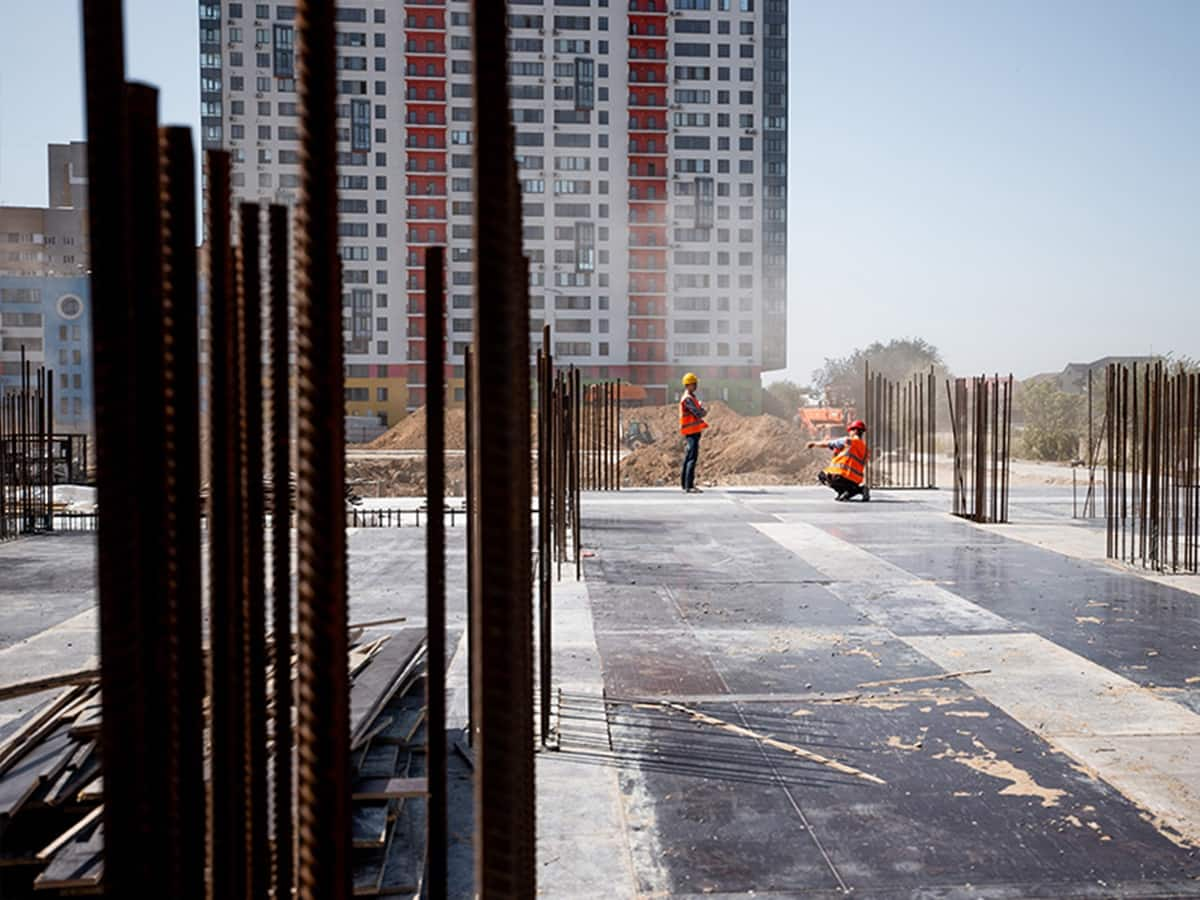

NACDAC Infra, fashioned within the 12 months 2012, manufactures multi-storey buildings, residential, industrial and institutional constructions. It has thus far accomplished 45 initiatives of the Authorities of India and the Authorities of Uttarakhand. Speaking in regards to the monetary well being of the corporate, it has repeatedly strengthened. Within the monetary 12 months 2022, it had a web revenue of Rs 31.55 lakh, which jumped to Rs 56.15 lakh within the subsequent monetary 12 months 2023 and to Rs 3.17 crore within the monetary 12 months 2024. Throughout this era, the corporate’s income elevated at a compound progress fee (CAGR) of greater than 87 % yearly to Rs 36.33 crore. Speaking in regards to the present monetary 12 months 2024-25, it has achieved web revenue of Rs 1.60 crore and income of Rs 13.76 crore in April-October 2024.

One other IPO of ₹150 crore is coming, draft deposited with SEBI; Solely new shares will likely be issued

NACDAC Infra IPO Itemizing: IPO bid 2200 instances, now ₹35 share on itemizing, funding doubled

देश दुनियां की खबरें पाने के लिए ग्रुप से जुड़ें,

#INA #INA_NEWS #INANEWSAGENCY

Copyright Disclaimer :-Beneath Part 107 of the Copyright Act 1976, allowance is made for “truthful use” for functions comparable to criticism, remark, information reporting, educating, scholarship, and analysis. Honest use is a use permitted by copyright statute which may in any other case be infringing., instructional or private use suggestions the steadiness in favor of truthful use.